do you pay taxes on inheritance in north carolina

The federal estate tax exemption is 1158 million in 2020 so only estates larger than that amount will owe federal estate taxes. An inheritance of 382 million falls into the highest tax rate so youll have to pay 40.

Inheritance Format Fill Online Printable Fillable Blank Pdffiller

North Carolina does not have these kinds of taxes which some states levy on people who.

. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. The goods news is that there is no federal. North Carolinas income tax is a flat rate of.

There is no inheritance tax in North Carolina. No Inheritance Tax in NC. For a home valued at 500000 a 25-cent increase would add 1042 per month in local taxes.

As you can imagine an inheritance tax can have a significant i See more. However state residents should remember. However state residents should remember to take into account the federal estate tax if their estate or the.

In this case if the inheritor sells the property at the best value of 375000 then he pays capital gain tax against 25000 only. Conditioning the inherited house. Do you pay taxes on inheritance in north carolina Saturday June 11 2022 Edit.

When does a North Carolina resident pay the death taxes. North Carolina residents do not need to worry about a state estate or inheritance tax. How much can you inherit without paying taxes in NC.

However state residents should remember to take into account the federal estate tax if their estate or the. Taxpayers can pay their taxes through a. Additionally do you have to pay taxes on inheritance in North Carolina.

However there are sometimes taxes for other reasons. These are some of the taxes you may have to think about. In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax.

Estate taxes are imposed on the total value of the estate - if the total estate value. North Carolina does not collect an inheritance tax or an estate tax. This gift-tax limit does not refer to.

Large estates that exceed a lifetime exemption of 1206. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. Another way in which the transfer of wealth can be taxed is through the collection of an inheritance tax Unlike gift and estate taxes which are paid by the estate before the transfer of an asset an inheritance tax is paid by the recipient of the gift afterthe transfer.

Solution North Carolina does not collect an inheritance tax or an estate tax. Gifts of less than 15000 per year per individual are not taxed. There is no inheritance tax in NC.

No Inheritance Tax in NC. The estate may be liable for federal estate taxNorth Carolina currently has no inheritance taxif the amount of the inheritance is above the estate tax threshold. If you die intestate each of your.

That is 152 million. Social Security is not taxed but other retirement income sources are fully taxed. North Carolina does not collect an inheritance tax or an estate tax.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky. With the property tax your federal tax would be 187 million. North Carolina Estate Tax Everything You Need To Know Smartasset.

North Carolina is moderately tax-friendly for retirees. However - there is no inheritance taxes on neither federal nor state level in North Carolina. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within.

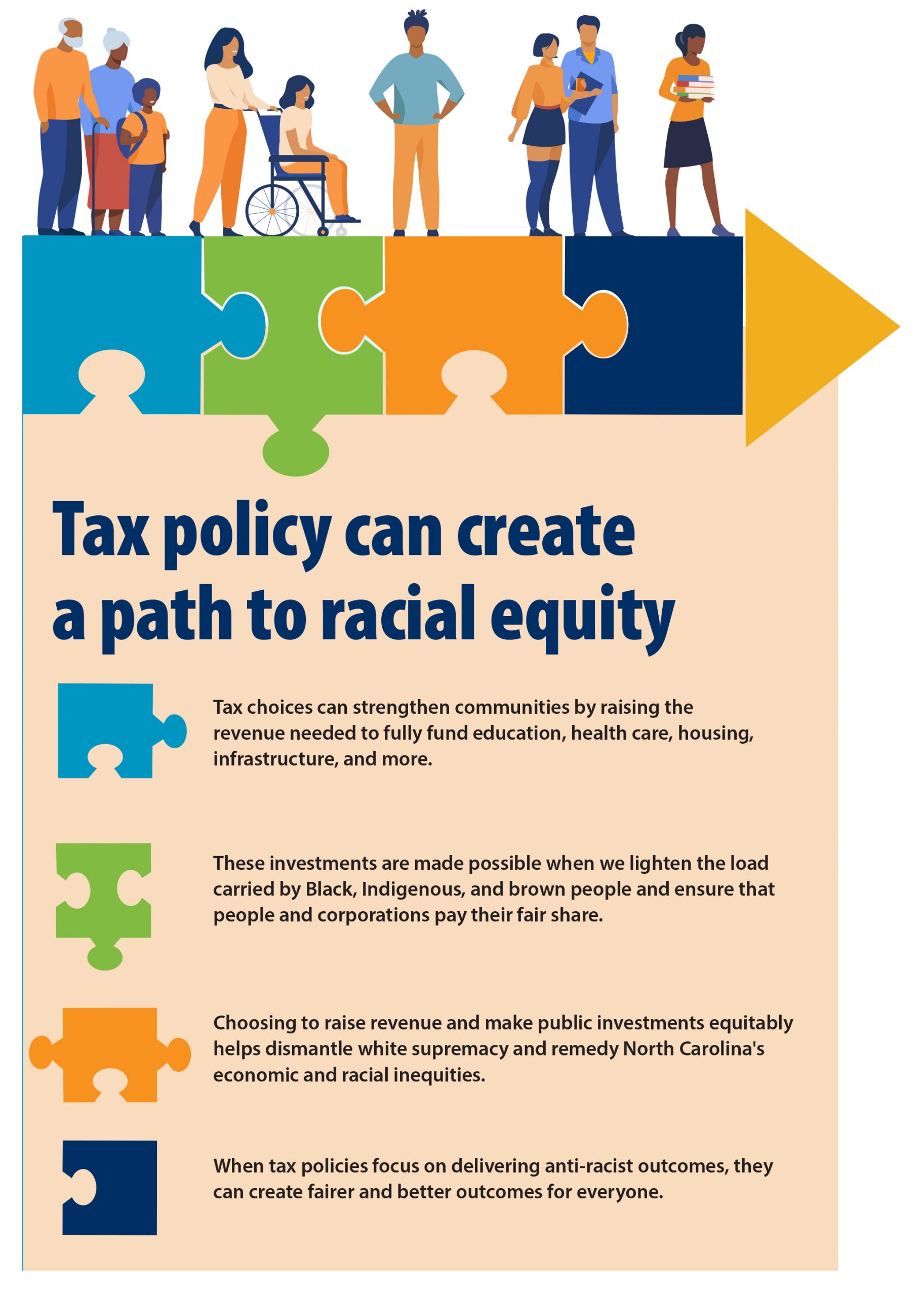

State Tax Policy Is Not Race Neutral North Carolina Justice Center

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

State Estate And Inheritance Taxes

How Do State And Local Property Taxes Work Tax Policy Center

Selling An Inherited Property In North Carolina 2022 Updates

Is Your Inheritance Considered Taxable Income H R Block

North Carolina Tax Legislation Update What Changes Are Coming For North Carolina Taxpayers Bernard Robinson Company

Here Are The States With No Estate Or Inheritance Taxes Gobankingrates

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

How Much Is Inheritance Tax Community Tax

What Is Inheritance Tax Probate Advance

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

How To Avoid Paying Taxes On Inherited Property Smartasset

Nj Division Of Taxation Inheritance And Estate Tax

A Guide To North Carolina Inheritance Laws

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation